China has essentially monopolized rare earth elements (REEs), the unsung heroes of modern technology, for decades. Although these 17 metals run everything from fighter planes to cell phones, their supply chain has long been a geopolitical flashpoint. Now, a ground-breaking discovery from Australian company Lynas Rare Earths has industry leaders and scientists humming: the first commercial heavy rare earth production outside of China. Though this seems like a “major milestone” in diversifying the world supply, experts caution that the road to true independence from Beijing’s dominance is still paved with challenges from environmental issues to economic viability. Apart from consequences for world trade and future sustainable development, this discovery is significant for the following reasons as well.

China’s Stranglehold on Rare Earths And Why It Matters

Undoubtedly the kingpin of a sector vital to electric vehicles (EVs), wind turbines, and defense systems, China controls over 60% of the rare earth mining worldwide and 92% of the refining. This dominance results from decades of state-sponsored industrial policy, lax environmental rules, and aggressive pricing policies that have suppressed competition; it is not accidental.

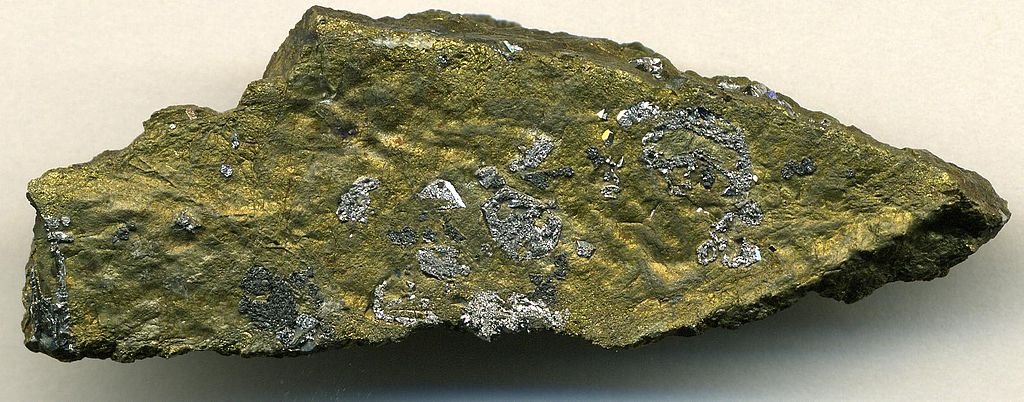

The most sought-after REEs, neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and terbium (Tb), are essential for high-performance magnets in EVs and renewable energy tech. With the West scrambling to secure alternatives, Lynas’ breakthrough couldn’t be timelier. But as one analyst puts it, “This is a start, not a solution.”

Lynas’ Heavy Rare Earth Breakthrough: A Game Changer?

In a historic first, Lynas successfully produced dysprosium oxide at its Malaysian plant, with plans to refine terbium next month marking the only commercial heavy rare earth production outside China. Dysprosium, crucial for magnets that withstand high temperatures, and terbium, used in lasers and energy-efficient lighting, are among the rarest and most expensive REEs.

Still, the celebration is accompanied with certain restrictions:

- Limited output: Lynas’ ore contains minimal heavy rare earths, capping production volumes.

- Geopolitical bottlenecks: China’s export controls and permit backlogs continue to disrupt global supply chains.

- Price volatility: Current market prices barely support non-Chinese projects, leaving Lynas and others walking a financial tightrope.

“Lynas can make terbium and dysprosium, but not enough, and more is needed,” rare earths specialist Jon Hykawy warns.

The Dirty Secret of Rare Earth Mining And Why the West Lags Behind

China’s supremacy goes beyond volume to include cost-cutting at an environmental cost. In countries with tighter rules, the nation’s reliance on cheap but polluting in-situ leaching is a non-starter. Without subsidies or skyrocketing prices, Western projects suffer more costs, slower permits, and public opposition, so making profitability elusive.

“Production outside China is more expensive, so they need prices to rise to make serious profits,” Hykawy says. Many non-Chinese mines are struggling to break even with NdPr down 9% in 2024 and dysprosium falling 33%.

The Geopolitical Chessboard: Trade Wars and Tariffs

The Lynas milestone arrives amid rising U.S.-China trade tensions, where rare earths have become a negotiating tool. Beijing’s export restrictions combined with recent U.S. tariffs on Chinese EVs and critical minerals have increased supply chain fears.

A looming wildcard? Myanmar, which supplied 40% of China’s heavy rare earth feedstocks before border clashes disrupted trade. If Myanmar’s exports remain blocked, prices for Dy and Tb could skyrocket, handing Lynas a potential windfall.

Who Else Is Joining the Race?

Lynas isn’t alone in the push for diversification:

- MP Materials (U.S.): Piloting heavy rare earth separation, with plans to scale in 2025.

- Aclara Resources (Canada): Developing a U.S. processing plant.

- Defense Metals (Canada): Partnering on rare earth refining tech.

Lynas itself is expanding its Malaysian facility to produce 1,500 tonnes of heavy REEs annually, potentially capturing a third of global supply. A planned Texas plant could further tilt the scales, though funding hurdles remain.

The Road Ahead: A Fragile Hope

While Lynas’ achievement is a watershed moment, experts agree: China’s grip won’t loosen overnight. True supply chain resilience will require:

- More mines and refineries outside China.

- Higher prices to justify Western projects.

- Recycling breakthroughs to reduce reliance on mining.

“The Lynas announcement shows progress is possible,” says Benchmark’s Neha Mukherjee. “But without sustained investment and geopolitical will, we’re just nibbling at the edges of China’s monopoly.”

For now, the world watches and waits to see if this rare earth rebellion gains momentum.

Sources:

Jan loves Wildlife and Animals and is one of the founders of Animals Around The Globe. He holds an MSc in Finance & Economics and is a passionate PADI Open Water Diver. His favorite animals are Mountain Gorillas, Tigers, and Great White Sharks. He lived in South Africa, Germany, the USA, Ireland, Italy, China, and Australia. Before AATG, Jan worked for Google, Axel Springer, BMW and others.